By Katie Plocheck Hunt

The Challenge

We can likely all relate to hearing a story about a crime and thinking to ourselves, “If I were targeted in that circumstance, I would have never gotten into that car, given that person my personal information, or worn that outfit…” The list goes on. Unfortunately, in America, “victim blaming” — holding the person who was targeted responsible for the crime rather than the criminal — is too commonplace. Movies and stories laud the criminal as the hero, often portrayed as skillful, stealthy, smart. The victim, alternatively, is often characterized as gullible and unscrupulous.

Why do we tend to blame victims, or see them as less? It extends, in some part, from cultural values such as the “American Dream” where we exalt self-responsibility and individualism. We live by the tenet that it’s us who controls our own fate.

There is also the psychological phenomenon of the “just-world theory” that we perceive the world as mostly good. If bad things happen, that’s our own fault. And the idea of attribution bias explains a tendency to explain a person’s behavior by holding their character more accountable than any situational factors at play.

Holding to these beliefs, non-victims can create an illusion of safety for themselves and more easily justify a lack of empathy, resources, time, or attention that would otherwise be needed to truly see the person targeted. And while this may seem an innocuous (albeit unfair) habit, it produces heartbreaking results: those targeted tend to turn the blame they hear onto themselves. The outcome? Staggering levels of shame, repeat targeting, isolation and, in the most extreme cases, death by suicide.

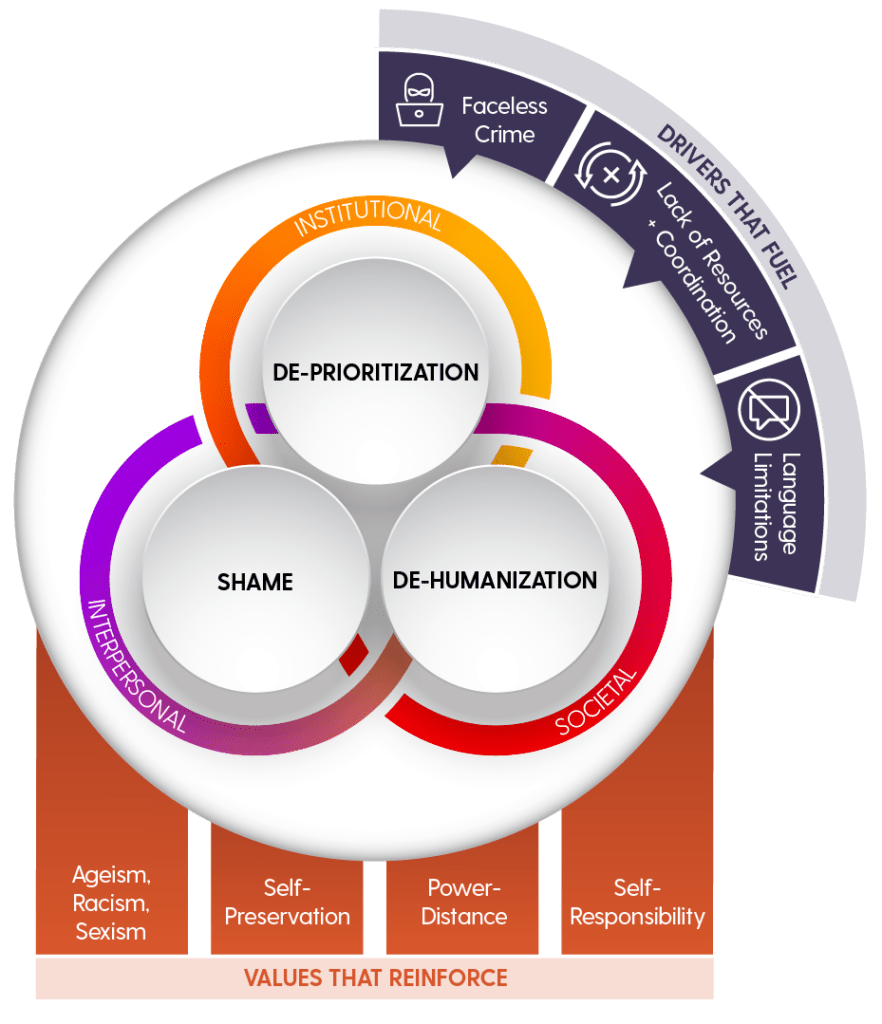

Heart+Mind recently partnered with both the FINRA Foundation and AARP, two organizations committed to ending victim blaming when it comes to targets of financial fraud. Together we sought to better understand the cultural systems that propagate this practice at the interpersonal, institutional, and societal levels. Our goal was to shed light on the practice of victim blaming and identify strategies for how to eradicate it.

The Human Toll of Victim Blaming

We discovered that rather than outright blaming the person targeted, most people are more frequently responsible for shaming and minimizing the crime. This dehumanizes the person involved and their experience. Ultimately, the culture of victim “blaming” is about the words we use and practices we embrace — it causes damage far beyond financial loss.

A former prosecutor shared the following story about a victim of fraud:

“I think some people shut down…and I’ve seen that for myself, they move into a state of depression that they can’t ever get out of…They lost their smile. I’ve read cases of where people have actually [died by] suicide after discovering they’ve lost their life savings to a perpetrator.”

Beyond feeling deep shame, creating mental health issues, and driving repeat victimization, victim blaming leads to a gross under-reporting of crimes. This prevents us from being able to fully grasp the magnitude of fraud today. This can also mean investigations, prosecutions, and even legislative actions are not prioritized. And thus, the cycle repeats. Each tier reinforces the others, creating an endless churn pushing blame outward and internalizing shame.

But there is hope. There are solutions we can employ. Together we can put an end to this vicious cycle of victim blaming.

Combating Victim Shame

Change will require a shift to focus more on the crime and the criminals. We need greater empathy as a society for people who are targeted in scams and financial fraud. We need a movement, and we believe it starts here:

- Address the values that underly victim blaming. This requires a culture shift. It starts with education about the realities of fraud and what it means to be targeted. We need to help those involved to know and feel they are not alone. They need to see that fraud can happen to anyone, and their effort to report it is a critical step to combat shaming.

- Increase focus on the perpetrator and the crime itself. While criminals are hard to catch, we can change the narrative in the media, entertainment, and news coverage.

- Prioritize fighting scams and financial fraud at the institutional level. When people see charges being filed and criminals being prosecuted it demonstrates the seriousness of fraud and decreases victim blaming. This feeds more reporting and lowers shame.

- Use alternative language to describe victims, criminals, and the fraud. While certain language intentionally disparages the person targeted, most shaming is inadvertent because we lack a lexicon for talking about it. Referring to financial “assault” rather than “fraud” or “scam” is a start. We need to find language that matches the crime.

- Humanize the emotional toll of fraud. Raise awareness of what happens in the lives of the people targeted. The societal costs are hard to calculate, and we need to find ways to track and share this better to draw attention. But the personal stories of what happens to victims resonate more deeply and generate greater empathy.

The Call to Action

Each of us needs to revisit our own response the next time we hear of a scam or fraud. Instead of thinking less of the person who was targeted, remember it was the criminal who intentionally stole money, identity, or other resources. Empathize with the victim, repudiate the crime. When you engage, listen more than you react. If you’re in a position to help, encourage and support responsible reporting to the authorities.

We call on legislative bodies and government agencies to streamline reporting, enhance investigative collaboration, and strengthen prosecutorial authority across jurisdictions. Law enforcement needs the tools and the mandate to fight the criminals stealing billions through scams and fraud.

We also challenge the news media and entertainment industry to use language and storytelling that supports the people targeted by financial fraud rather than glorifying the people who commit financial fraud.

These changes might seem small, but they will create a powerful ripple effect that can drive systemic change. When we choose to support and not blame, we champion humanity.